Capital Effectiveness & Efficiency

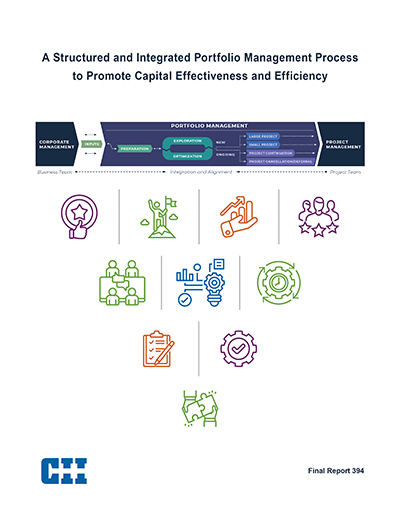

The Portfolio Management Process sits between Corporate Management and Project Management. Figure 1 offers a visual representation of the Portfolio Management Process, showing its link to Corporate Management and Project Management, as well as the stages and activities necessary to identify, select, develop, and manage the capital project portfolio effectively and efficiently.

Figure 1. The Relationship between Corporate Management, the Identified Portfolio Management Stages, and Project Management

Each stage of the Portfolio Management Process is divided into multiple activities. Each activity has the following characteristics:

- Description: Detailed explanation of the activity and its role in the portfolio management process.

- Basic Steps: General step-by-step overview on how to perform the activity.

- Potentially Relevant Parties: List of potentially relevant organizational functions and departments that could be involved to complete the activity and integrate business and project teams.

- Potentially Relevant Inputs: List of potentially relevant input information necessary to complete the activity and integrate business and project teams.

- Potentially Relevant Outputs: List of potentially relevant output information necessary to complete the activity and integrate business and project teams.

- Activity-specific Benefits of Business-Project Team Integration: Explanation of the relevancy of integrating business and project teams during that activity and how it contributes to improving capital effectiveness and capital efficiency.

- Observations from Case Studies: Relevant implementations of the activity as the team observed from industry cases.

A key aspect of the Portfolio Management Process is the importance of business-project team integration. Organizations can use this tool to integrate their business and project teams during portfolio planning and project initiation.